Investigative due diligence services of SA WEST Global intelligence help buyers in making confident decisions.

We work mainly in Russian Federation and Former Soviet Countries, Europe, and Southwest Asia.

What Makes Investigative Due Diligence a Distinctive Service?

All common types of due diligence: commercial, legal, financial, ecological, and others require a lot of paperwork between the Buyer and the Vendor. The Buyer must show his intent to consider the acquisition before he can initiate due diligence process.

Sometimes, and often enough, the Buyer would like not to disclose his plans to the Vendor until he is confident enough in the potential of the deal. Investigative due diligence is the only solution in this case.

To the above of regular matters of interest, like corporate structure of the Vender, its beneficial owners, finances, value added chain of the Vendor, etc, Investigative due diligence report uncovers important issues that are not in focus of common due diligence practices: criminal or governmental relations of the Vendor, links between the Vendor and its customers/suppliers, unreported obligations of the Vendor.

Why Common In-House Due Diligence Is Not Enough?

Modern vendors are good in preparing the company for acquisition. Consulting companies, law firms, and advisors are working for Vendors to help them in selling the businesses with the highest add-value. Same experts are good in conducting in-house due diligence, when the team has direct access to previously polished financial reports, to instructed and happy employees, to reliable customers and suppliers.

In-house due diligence is unavoidable and must be conducted by the best available on the market team of experts. These experts, if they intend to provide the Buyer with accurate and reliable report, will assign resourceful company with expertise in intelligence datamining to do some researches for in-house due diligence team.

Some of our investigative due diligence projects were made in cooperation with law firms and consulting companies conducting common due diligence researches.

To the above, investigative due diligence can save Buyers money and nerves in international M&A deals in volatile environments of developing countries.

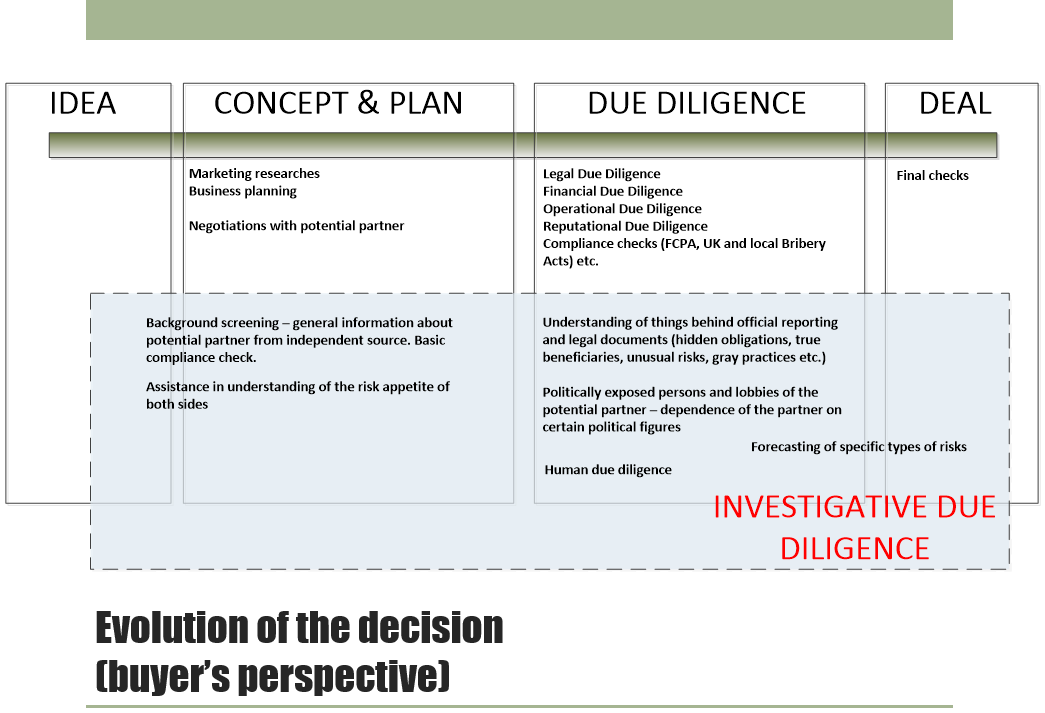

The scheme below provides general overview of cooperation between the Buyer and SA WEST Global intelligence.

Why Investigative Due Diligence Is Important Before (not after) Making a Purchase Decision or signing of MoA?

The Buyer can face old “hidden” debts of the Vendor. After the deal he can be obliged to pay kick-backs to local organized crime or governmental authorities.

Working only on the site of the company it is hard to conduct accurate FCPA and UK Bribery Act compliance checks. Accurate and professionally made reports of compliance experts will be solid only if these experts have access to sources and information hardly available for professionals without appropriate background in intelligence and corporate investigations. Terrorism financing is also not a fiction especially in Central Africa and the Middle East. Purchasing of a company that was somehow involved in illegitimate activity and especially in terrorism financing is a serious crime. This can damage your reputation unless you do investigative due diligence research and aware of the situation before making the decision to acquire the company.

Interpersonal relations of top-managers with key clients, providers and regulating authorities are often underestimated even at the final stage of the deal. Interviews of HRs can bring no valuable results, because top-managers prefer keeping their secrets to themselves. Investigative human due diligence research will help you in understanding plans, intentions, connections and personality of vendor’s top-managers and business partners before you purchase the company.